What if a little information really was a dangerous thing for your company? Many companies hold onto as much information as they can for both compliance purposes and record keeping. But it turns out there is some information that really should be destroyed.

Wondering what needs to be destroyed and what you should keep? Keep reading to find out!

Know the Rules

It’s important to destroy data that you no longer need. However, you may be legally required to hold onto certain data longer than other data.

For example, the IRS can look at business tax records that are up to six years old. Because of this, many individuals and businesses hold onto important records for seven years to play it safe.

Make sure that you are very familiar with the policies containing how long you must hold onto things like confidential information. Ensure this is followed by creating retention policies and enforcing them strictly throughout the company.

Why Destroy Data?

We’ve discussed knowing when to hold onto data and when to destroy it. But that leaves a big question: why destroy data in the first place?

The short answer to this is “efficiency.” And this efficiency extends to both the physical and the digital realms.

For example, if your computer hard drives and company e-mail are clogged with unnecessary data, things are going to move very slowly. And if this information is held as physical media, then it is literally taking up space that could be used for more valuable documents.

Plus, you never know who could access old data that you don’t destroy.

What Documents Should Be Destroyed?

Now you know why data destruction should be a priority for your company. What, then, should you be targeting? It turns out this is something of a trick question.

It’s generally good to hold onto things like employee records and tax documentation. And you should retain important information for employees such as their pension documentation.

Conversely, you can destroy the same data after a set period of time. For example, it is legal in many states to destroy these same records after a period of six years unless they are still useful or required (such as documentation that would be required for a current or upcoming legal case).

Beyond this minimum period of time, it is recommended to destroy as much physical and digital data as possible. Every file destroyed moves your company a step closer to peak efficiency!

What other documents should be shredded?

- Employee pay stubs

- Employment records and payroll information

- Credit card bills or offers

- Bank statements

- ID cards

- Legal documents

- Canceled or voided checks

- Anything with a signature

- Budgets

- Contracts

- Strategic Reports

- Training information

- Appraisals

- Applications

- Purchase orders

- Internal reports

- Customer lists

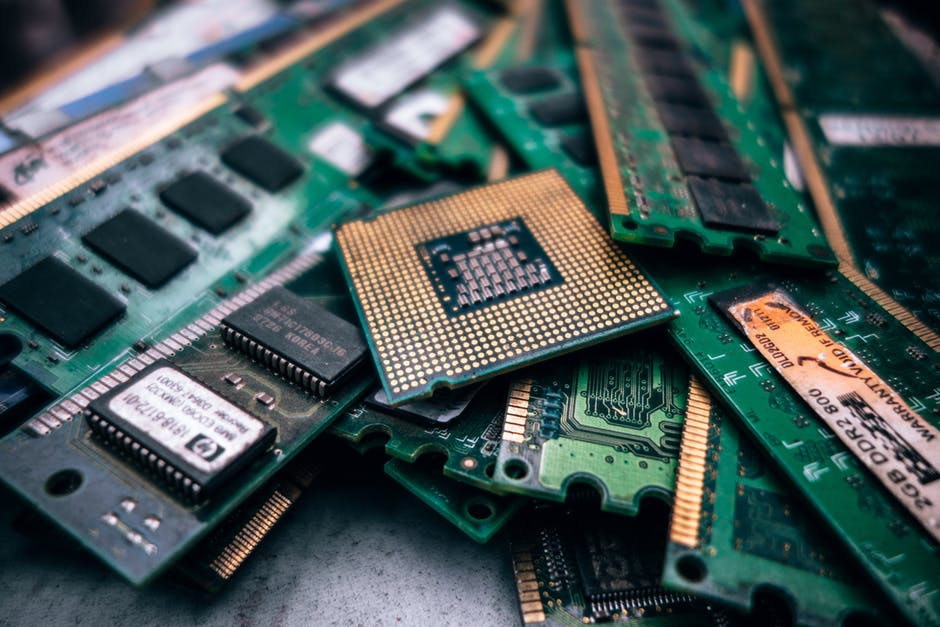

- Old computer hard drives

- Any document with personal or confidential information

Methods of Data Destruction

So, you’re ready to destroy the data. How, then, do you go about it?

Physical data is relatively easy to destroy. It’s simple to shred selected documents. However, store purchased shredders leave larger pieces of information that can still be read or put back together. Instead, opt for a professional shredding company. They can help you come up with a destruction schedule to be sure your confidential documents are kept secure and private.

Electronic data is trickier to destroy. For example, it’s not enough to simply delete the files from a computer because such data can still be accessed from the device. Make sure your electronic data is properly destroyed by a hard drive destruction company.

Document Destruction in Fort Wayne

Now you know more about how data destruction works. But do you know who can help you complete this task? At Federal Records Management and Shredding, we specialize in safely and securely destroying both documents and data. Contact us today to learn how we can help you keep all of your files secure.